Which of the following are reasons for companies to use controlled disbursement?

I. To obtain timely check presentment information

II. To enhance supplier relationships

III. To increase their available cash

IV. To improve their overall creditworthiness

What type of insurance provides payments to an organization if it is unable to continue operations for some period due to an unforeseen event?

In recent years, there has been a sharp increase in the use of technology for certain financial transactions. Which of the following has increased dramatically over recent years?

Which of the following is a disadvantage of e-commerce?

Companies that seek out other companies that have successfully redesigned their operations are engaging in a process called:

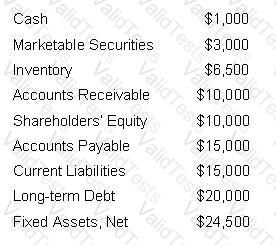

BF Company, a manufacturer of food products, reported financial information shown in the Exhibit for the end of the year. BF Company is subject to covenants in its commercial paper program. It is in compliance with which of the following?

When a paper check is converted to an electronic form:

A company may choose to outsource some of its cash management processes to:

A company wishes to monitor and control office expenses incurred by its employees. Which of the following offers the BEST method of providing the employees freedom to choose different vendors while maximizing spending control?

Which agency appoints the chairman and members of the Public Company Accounting Oversight Board?

Refer to the following information about a company at the end of its fiscal year.

The before-tax cost of long-term debt is 10% and the cost of equity is 12%. The marginal tax rate is 35%.

What is the company's long-term debt to total capitalization ratio?

Capital budgeting decisions are most commonly evaluated in terms of:

A digital signature cannot be forged if:

The delay between the time a check is deposited and the time the company's account is credited with collected funds is known as:

Which of the following are examples of covenants in loan agreements?

I. Financial ratios

II. Corporate resolutions

III. Borrower limitations

IV. Borrower obligations

MICR encoding errors may be detected by all of the following TMS modules EXCEPT:

Which of the following is normally MORE significant for a corporation?

Controlled disbursement notification times can be improved by which of the following?

Which two of the following are optimal uses for short-term excess cash?

I. Pay down credit lines.

II. Make overnight investments.

III. Repurchase stock.

IV. Make capital expenditures.

A United States company must remit a dollar royalty payment to its Japanese subsidiary. Cash settlement of the payment would typically be made by which of the following?