Rachel is looking to put together a contract for the supply of raw materials to her manufacturing organisation and is considering a short contract (12 months) vs a long contract (5 years). What are the advantages and disadvantages of these options? (25 marks)

See the answer in Explanation below:

Rachel’s decision between a short-term (12 months) and long-term (5 years) contract for raw material supply will impact her manufacturing organization’s financial stability, operational flexibility, and supplier relationships. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, contract duration affects cost control, risk management, and value delivery. Below are the advantages and disadvantages of each option, explained in detail:

Short-Term Contract (12 Months):

Advantages:

Flexibility to Adapt:

Allows Rachel to reassess supplier performance, market conditions, or material requirements annually and switch suppliers if needed.

Example: If a new supplier offers better prices after 12 months, Rachel can renegotiate or switch.

Reduced Long-Term Risk:

Limits exposure to supplier failure or market volatility (e.g., price hikes) over an extended period.

Example: If the supplier goes bankrupt, Rachel is committed for only 12 months, minimizing disruption.

Opportunity to Test Suppliers:

Provides a trial period to evaluate the supplier’s reliability and quality before committing long-term.

Example: Rachel can assess if the supplier meets 98% on-time delivery before extending the contract.

Disadvantages:

Potential for Higher Costs:

Suppliers may charge a premium for short-term contracts due to uncertainty, or Rachel may miss bulk discounts.

Example: A 12-month contract might cost 10% more per unit than a 5-year deal.

Frequent Renegotiation Effort:

Requires annual contract renewals or sourcing processes, increasing administrative time and costs.

Example: Rachel’s team must spend time each year re-tendering or negotiating terms.

Supply Chain Instability:

Short-term contracts may lead to inconsistent supply if the supplier prioritizes long-term clients or if market shortages occur.

Example: During a material shortage, the supplier might prioritize a 5-year contract client over Rachel.

Long-Term Contract (5 Years):

Advantages:

Cost Stability and Savings:

Locks in prices, protecting against market volatility, and often secures discounts for long-term commitment.

Example: A 5-year contract might fix the price at £10 per unit, saving 15% compared to annual fluctuations.

Stronger Supplier Relationship:

Fosters collaboration and trust, encouraging the supplier to prioritize Rachel’s needs and invest in her requirements.

Example: The supplier might dedicate production capacity to ensure Rachel’s supply.

Reduced Administrative Burden:

Eliminates the need for frequent renegotiations, saving time and resources over the contract period.

Example: Rachel’s team can focus on other priorities instead of annual sourcing.

Disadvantages:

Inflexibility:

Commits Rachel to one supplier, limiting her ability to switch if performance declines or better options emerge.

Example: If a new supplier offers better quality after 2 years, Rachel is still locked in for 3 more years.

Higher Risk Exposure:

Increases vulnerability to supplier failure, market changes, or quality issues over a longer period.

Example: If the supplier’s quality drops in Year 3, Rachel is stuck until Year 5.

Opportunity Cost:

Locks Rachel into a deal that might become uncompetitive if market prices drop or new technologies emerge.

Example: If raw material prices fall by 20% in Year 2, Rachel cannot renegotiate to benefit.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide discusses contract duration as a key decision in procurement, impacting "cost management, risk allocation, and supplier relationships." It highlights that short-term and long-term contracts each offer distinct benefits and challenges, requiring buyers like Rachel to balance flexibility, cost, and stability based on their organization’s needs.

Short-Term Contract (12 Months):

Advantages: The guide notes that short-term contracts provide "flexibility to respond to market changes," aligning with L5M4’s risk management focus. They also allow for "supplier performance evaluation" before long-term commitment, reducing the risk of locking into a poor supplier.

Disadvantages: L5M4 warns that short-term contracts may lead to "higher costs" due to lack of economies of scale and "increased administrative effort" from frequent sourcing, impacting financial efficiency. Supply chain instability is also a concern, as suppliers may not prioritize short-term clients.

Long-Term Contract (5 Years):

Advantages: The guide emphasizes that long-term contracts deliver "price stability" and "cost savings" by securing favorable rates, a key financial management goal. They also "build strategic partnerships," fostering collaboration, as seen in supplier development (Question 3).

Disadvantages: L5M4 highlights the "risk of inflexibility" and "exposure to supplier failure" in long-term contracts, as buyers are committed even if conditions change. The guide also notes the "opportunity cost" of missing out on market improvements, such as price drops or new suppliers.

Application to Rachel’s Scenario:

Short-Term: Suitable if Rachel’s market is volatile (e.g., fluctuating raw material prices) or if she’s unsure about the supplier’s reliability. However, she risks higher costs and supply disruptions.

Long-Term: Ideal if Rachel values cost certainty and a stable supply for her manufacturing operations, but she must ensure the supplier is reliable and include clauses (e.g., price reviews) to mitigate inflexibility.

Financially, a long-term contract might save costs but requires risk management (e.g., exit clauses), while a short-term contract offers flexibility but may increase procurement expenses.

With reference to the SCOR Model, how can an organization integrate operational processes throughout the supply chain? What are the benefits of doing this? (25 points)

See the answer in Explanation below:

Part 1: How to Integrate Operational Processes Using the SCOR ModelThe Supply Chain Operations Reference (SCOR) Model provides a framework to integrate supply chain processes. Below is a step-by-step explanation:

Step 1: Understand SCOR ComponentsSCOR includes five core processes: Plan, Source, Make, Deliver, and Return, spanning the entire supply chain from suppliers to customers.

Step 2: Integration Approach

Plan:Align demand forecasting and resource planning across all supply chain partners.

Source:Standardize procurement processes with suppliers for consistent material flow.

Make:Coordinate production schedules with demand plans and supplier inputs.

Deliver:Streamline logistics and distribution to ensure timely customer delivery.

Return:Integrate reverse logistics for returns or recycling across the chain.

Step 3: ImplementationUse SCOR metrics (e.g., delivery reliability, cost-to-serve) and best practices to align processes, supported by technology like ERP systems.

Outcome:Creates a cohesive, end-to-end supply chain operation.

Part 2: Benefits of Integration

Step 1: Improved EfficiencyReduces redundancies and delays by synchronizing processes (e.g., faster order fulfillment).

Step 2: Enhanced VisibilityProvides real-time data across the chain, aiding decision-making.

Step 3: Better Customer ServiceEnsures consistent delivery and quality, boosting satisfaction.

Outcome:Drives operational excellence and competitiveness.

Exact Extract Explanation:

The CIPS L5M4 Study Guide details the SCOR Model:

Integration:"SCOR integrates supply chain processes—Plan, Source, Make, Deliver, Return—ensuring alignment from suppliers to end customers" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2). It emphasizes standardized workflows and metrics.

Benefits:"Benefits include increased efficiency, visibility, and customer satisfaction through streamlined operations" (CIPS L5M4 Study Guide, Chapter 2, Section 2.2).This supports strategic supply chain management in procurement. References: CIPS L5M4 Study Guide, Chapter 2: Supply Chain Performance Management.===========

Discuss ways in which an organization can improve their short-term cash flow (25 points)

See the answer in Explanation below:

Improving short-term cash flow involves strategies to increase cash inflows and reduce outflows within a short timeframe. Below are three effective methods, explained step-by-step:

Accelerating Receivables Collection

Step 1: Tighten Credit TermsShorten payment terms (e.g., from 60 to 30 days) or require deposits upfront.

Step 2: Incentivize Early PaymentsOffer discounts (e.g., 1-2% off) for payments made before the due date.

Step 3: Automate ProcessesUse electronic invoicing and reminders to speed up debtor responses.

Impact on Cash Flow:Increases immediate cash inflows by reducing the time money is tied up in receivables.

Delaying Payables Without Penalties

Step 1: Negotiate TermsExtend payment terms with suppliers (e.g., from 30 to 60 days) without incurring late fees.

Step 2: Prioritize PaymentsPay critical suppliers first while delaying non-urgent ones within agreed terms.

Step 3: Maintain RelationshipsCommunicate transparently with suppliers to preserve goodwill.

Impact on Cash Flow:Retains cash longer, improving short-term liquidity.

Selling Surplus Assets

Step 1: Identify AssetsReview inventory, equipment, or property for underutilized or obsolete items.

Step 2: Liquidate QuicklySell via auctions, online platforms, or trade buyers to convert assets to cash.

Step 3: Reinvest ProceedsUse funds to meet immediate cash needs or reduce short-term borrowing.

Impact on Cash Flow:Provides a quick influx of cash without relying on external financing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes practical techniques for short-term cash flow management:

Receivables Collection:"Accelerating cash inflows through tighter credit policies and incentives is a primary method for improving liquidity" (CIPS L5M4 Study Guide, Chapter 3, Section 3.2).

Delaying Payables:"Extending supplier payment terms, where possible, preserves cash for operational needs" (CIPS L5M4 Study Guide, Chapter 3, Section 3.5), though it advises maintaining supplier trust.

Asset Sales:"Liquidating surplus assets can provide an immediate cash boost in times of need" (CIPS L5M4 Study Guide, Chapter 3, Section 3.6), particularly for organizations with excess resources.These approaches are critical for procurement professionals to ensure financial agility. References: CIPS L5M4 Study Guide, Chapter 3: Financial Management Techniques.

Explain three different types of financial data you could collect on a supplier and what this data would tell you (25 marks)

See the answer in Explanation below:

Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

Profitability Ratios (e.g., Net Profit Margin):

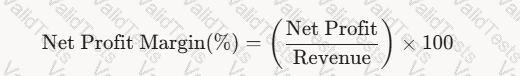

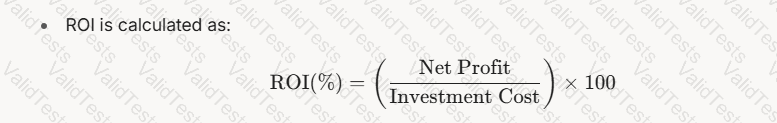

Description: Profitability ratios measure a supplier’s ability to generate profit from its operations. Net Profit Margin, for example, is calculated as:

A math equation with numbers and symbols

AI-generated content may be incorrect.

A math equation with numbers and symbols

AI-generated content may be incorrect.

This data is typically found in the supplier’s income statement.

What It Tells You:

Indicates the supplier’s financial health and efficiency in managing costs. A high margin (e.g., 15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or -5%) signals potential financial distress.

Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

Liquidity Ratios (e.g., Current Ratio):

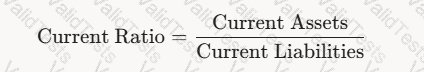

Description: Liquidity ratios assess a supplier’s ability to meet short-term obligations. The Current Ratio is calculated as:

A black text on a white background

AI-generated content may be incorrect.

A black text on a white background

AI-generated content may be incorrect.

This data is sourced from the supplier’s balance sheet.

What It Tells You:

Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues.

A low ratio may signal risk of delays or failure to deliver due to financial constraints.

Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing the risk of supply disruptions for the buyer.

Debt-to-Equity Ratio:

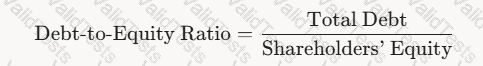

Description: This ratio measures a supplier’s financial leverage by comparing its total debt to shareholders’ equity:

A math equation with black text

AI-generated content may be incorrect.

A math equation with black text

AI-generated content may be incorrect.

This data is also found in the balance sheet.

What It Tells You:

Indicates the supplier’s reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier’s financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

Detailed Explanation of Each Type of Data:

Profitability Ratios (e.g., Net Profit Margin):

The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier’s operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value.

Liquidity Ratios (e.g., Current Ratio):

Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer’s operations and costs.

Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4’s focus on risk mitigation. The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

Debt-to-Equity Ratio:

The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

Broader Implications:

The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short-term obligations, posing a contract risk.

Financial data should be tracked over time (e.g., 3-5 years) to identify trends—e.g., a rising Debt-to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

In L5M4’s financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices.

Practical Application for XYZ Ltd:

Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract performance and financial efficiency.

A company is keen to assess the innovation capacity of a supplier. Describe what is meant by 'innovation capacity' and explain what measures could be used. (25 marks)

See the answer in Explanation below:

Innovation capacity refers to a supplier’s ability to develop, implement, and sustain new ideas, processes, products, or services that add value to their offerings and enhance the buyer’s operations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, assessing a supplier’s innovation capacity is crucial for ensuring long-term value, maintaining competitive advantage, and achieving cost efficiencies or performance improvements through creative solutions. Below is a detailed step-by-step solution:

Definition of Innovation Capacity:

It is the supplier’s capability to generate innovative outcomes, such as improved products, efficient processes, or novel business models.

It encompasses creativity, technical expertise, resource availability, and a culture that supports innovation.

Why It Matters:

Innovation capacity ensures suppliers can adapt to changing market demands, technological advancements, or buyer needs.

It contributes to financial management by reducing costs (e.g., through process improvements) or enhancing quality, aligning with the L5M4 focus on value for money.

Measures to Assess Innovation Capacity:

Research and Development (R&D) Investment: Percentage of revenue spent on R&D (e.g., 5% of annual turnover).

Number of Patents or New Products: Count of patents filed or new products launched in a given period (e.g., 3 new patents annually).

Process Improvement Metrics: Reduction in production time or costs due to innovative methods (e.g., 15% faster delivery).

Collaboration Initiatives: Frequency and success of joint innovation projects with buyers (e.g., 2 successful co-developed solutions).

Employee Innovation Programs: Existence of schemes like suggestion boxes or innovation awards (e.g., 10 staff ideas implemented yearly).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of supplier innovation as a driver of contractual success and financial efficiency. While the guide does not explicitly define "innovation capacity," it aligns the concept with supplier performance management and the ability to deliver "value beyond cost savings." Innovation capacity is framed as a strategic attribute that enhances competitiveness and ensures suppliers contribute to the buyer’s long-term goals.

Detailed Definition:

Innovation capacity involves both tangible outputs (e.g., new technology) and intangible strengths (e.g., a proactive mindset). The guide suggests that suppliers with high innovation capacity can "anticipate and respond to future needs," which iscritical in dynamic industries like technology or manufacturing.

It is linked to financial management because innovative suppliers can reduce total cost of ownership (e.g., through energy-efficient products) or improve return on investment (ROI) by offering cutting-edge solutions.

Why Assess Innovation Capacity:

Chapter 2 of the study guide highlights that supplier performance extends beyond meeting basic KPIs to delivering "strategic benefits." Innovation capacity ensures suppliers remain relevant and adaptable, reducing risks like obsolescence.

For example, a supplier innovating in sustainable packaging could lower costs and meet regulatory requirements, aligning with the L5M4 focus on financial and operational sustainability.

Measures Explained:

R&D Investment:

The guide notes that "investment in future capabilities" is a sign of a forward-thinking supplier. Measuring R&D spend (e.g., as a percentage of revenue) indicates commitment to innovation. A supplier spending 5% of its turnover on R&D might develop advanced materials, benefiting the buyer’s product line.

Patents and New Products:

Tangible outputs like patents demonstrate a supplier’s ability to innovate. The guide suggests tracking "evidence of innovation" to assess capability. For instance, a supplier launching 2 new products yearly shows practical application of creativity.

Process Improvements:

Innovation in processes (e.g., lean manufacturing) can reduce costs or lead times. The guide links this to "efficiency gains," a key financial management goal. A 10% reduction in production costs due to a new technique is a measurable outcome.

Collaboration Initiatives:

The study guide encourages "partnership approaches" in contracts. Joint innovation projects (e.g., co-developing a software tool) reflect a supplier’s willingness to align with buyer goals. Success could be measured by project completion or ROI.

Employee Innovation Programs:

A culture of innovation is vital, as per the guide’s emphasis on supplier capability. Programs encouraging staff ideas (e.g., 20 suggestions implemented annually) indicate a grassroots-level commitment to creativity.

Practical Application:

To assess these measures, a company might use a supplier evaluation scorecard, assigning weights to each metric (e.g., 30% for R&D, 20% for patents). The guide advises integrating such assessments into contract reviews to ensure ongoing innovation.

For instance, a supplier with a high defect rate but strong R&D investment might be retained if their innovation promises future quality improvements. This aligns with L5M4’s focus on balancing short-term performance with long-term potential.

Broader Implications:

Innovation capacity can be a contractual requirement, with KPIs like "number of innovative proposals submitted" (e.g., 4 per year) formalizing expectations.

The guide also warns against over-reliance on past performance, advocating for forward-looking measures like those above to predict future value.

Financially, innovative suppliers might command higher initial costs but deliver greater savings or market advantages over time, a key L5M4 principle.

ABC Ltd wishes to implement a new communication plan with various stakeholders. How could ABC go about doing this? (25 points)

See the answer in Explanation below:

To implement a new communication plan with stakeholders, ABC Ltd can follow a structured approach to ensure clarity, engagement, and effectiveness. Below is a step-by-step process:

Identify Stakeholders and Their Needs

Step 1: Stakeholder MappingUse tools like the Power-Interest Matrix to categorize stakeholders (e.g., employees, suppliers, customers) based on influence and interest.

Step 2: Assess NeedsDetermine communication preferences (e.g., suppliers may need contract updates, employees may want operational news).

Outcome:Tailors the plan to specific stakeholder requirements.

Define Objectives and Key Messages

Step 1: Set GoalsEstablish clear aims (e.g., improve supplier collaboration, enhance customer trust).

Step 2: Craft MessagesDevelop concise, relevant messages aligned with objectives (e.g., “We’re streamlining procurement for faster delivery”).

Outcome:Ensures consistent, purpose-driven communication.

Select Communication Channels

Step 1: Match Channels to StakeholdersChoose appropriate methods: emails for formal updates, meetings for key partners, social media for customers.

Step 2: Ensure AccessibilityUse multiple platforms (e.g., newsletters, webinars) to reach diverse groups.

Outcome:Maximizes reach and engagement.

Implement and Monitor the Plan

Step 1: Roll OutLaunch the plan with a timeline (e.g., weekly supplier briefings, monthly staff updates).

Step 2: Gather FeedbackUse surveys or discussions to assess effectiveness and adjust as needed.

Outcome:Ensures the plan remains relevant and impactful.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes structured communication planning:

"Effective communication requires identifying stakeholders, setting clear objectives, selecting appropriate channels, and monitoring outcomes" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8). It stresses tailoring approaches to stakeholder needs and using feedback for refinement, critical for procurement and contract management. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.===========

XYZ Ltd is a retail organization that is conducting a competitive benchmarking project. What are the advantages and disadvantages of this? (25 points)

See the answer in Explanation below:

Competitive benchmarking involves XYZ Ltd comparing its performance with a rival retailer. Below are the advantages and disadvantages, explained step-by-step:

Advantages

Identifies Competitive Gaps

Step 1: ComparisonXYZ assesses metrics like pricing, delivery speed, or customer service against a competitor.

Step 2: OutcomeHighlights areas where XYZ lags (e.g., slower delivery), driving targeted improvements.

Benefit:Enhances market positioning.

Drives Performance Improvement

Step 1: LearningAdopting best practices from competitors (e.g., efficient inventory management).

Step 2: OutcomeBoosts operational efficiency and customer satisfaction.

Benefit:Strengthens competitiveness in retail.

Market Insight

Step 1: AnalysisProvides data on industry standards and trends.

Step 2: OutcomeInforms strategic decisions (e.g., pricing adjustments).

Benefit:Keeps XYZ aligned with market expectations.

Disadvantages

Data Access Challenges

Step 1: LimitationCompetitors may not share detailed performance data.

Step 2: OutcomeRelies on estimates or public info, reducing accuracy.

Drawback:Limits depth of comparison.

Risk of Imitation Over Innovation

Step 1: FocusCopying rivals may overshadow unique strategies.

Step 2: OutcomeXYZ might lose differentiation (e.g., unique branding).

Drawback:Stifles originality.

Resource Intensive

Step 1: EffortRequires time, staff, and costs to gather and analyze data.

Step 2: OutcomeDiverts resources from other priorities.

Drawback:May strain operational capacity.

Exact Extract Explanation:

The CIPS L5M4 Study Guide discusses competitive benchmarking:

Advantages:"It identifies gaps, improves performance, and provides market insights" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).

Disadvantages:"Challenges include limited data access, potential over-reliance on imitation, and high resource demands" (CIPS L5M4 Study Guide, Chapter 2, Section 2.6).This is key for retail procurement and financial strategy. References: CIPS L5M4 StudyGuide, Chapter 2: Supply Chain Performance Management.===========

What are KPIs and why are they used? Give examples.

See the answer in Explanation below:

Key Performance Indicators (KPIs) are quantifiable metrics used to evaluate the success of an organization, project, or individual in meeting predefined objectives. Within the scope of the CIPS L5M4 Advanced Contract and Financial Management module, KPIs play a pivotal role in monitoring and managing contract performance, ensuring financial efficiency, and delivering value for money. They provide a structured framework to assess whether contractual obligations are being fulfilled and whether financial and operational goals are on track. KPIs are used to enhance transparency, foster accountability, support decision-making, and drive continuous improvement by identifying strengths and weaknesses in performance. Below is a detailed step-by-step solution:

Definition of KPIs:

KPIs are specific, measurable indicators that reflect progress toward strategic or operational goals.

They differ from general metrics by being directly tied to critical success factors in a contract or financial context.

Characteristics of Effective KPIs:

Specific: Clearly defined to avoid ambiguity (e.g., "on-time delivery" rather than "good service").

Measurable: Quantifiable in numerical terms (e.g., percentage, cost, time).

Achievable: Realistic within the contract’s scope and resources.

Relevant: Aligned with the contract’s purpose and organizational goals.

Time-bound: Measured within a specific timeframe (e.g., monthly, quarterly).

Why KPIs Are Used:

Performance Monitoring: Track supplier or contractor adherence to agreed terms.

Risk Management: Identify deviations early to mitigate potential issues (e.g., delays or cost overruns).

Financial Control: Ensure budgets are adhered to and cost efficiencies are achieved.

Accountability: Hold parties responsible for meeting agreed standards.

Continuous Improvement: Provide data to refine processes and enhance future contracts.

Examples of KPIs:

Operational KPI:Percentage of On-Time Deliveries– Measures the supplier’s ability to deliver goods or services within agreed timelines (e.g., 98% of shipments delivered on schedule).

Financial KPI:Cost Variance– Compares actual costs to budgeted costs (e.g., staying within 5% of the allocated budget).

Quality KPI:Defect Rate– Tracks the proportion of defective items or services (e.g., less than 1% defects in a production batch).

Service KPI:Response Time– Evaluates how quickly a supplier addresses issues (e.g., resolving complaints within 24 hours).

Sustainability KPI:Carbon Footprint Reduction– Measures environmental impact (e.g., 10% reduction in emissions from logistics).

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide positions KPIs as a cornerstone of effective contract management. According to the guide, KPIs are "quantifiable measures that allow organizations to assess supplier performance against contractual obligations and financial targets." They are not arbitrary metrics but are carefully selected to reflect the contract’s priorities, such as cost efficiency, quality, or timely delivery. The guide stresses that KPIs must be agreed upon by all parties during the contract negotiation phase to ensure mutual understanding and commitment.

Detailed Purpose:

Monitoring and Evaluation: Chapter 2 of the study guide explains that KPIs provide "a systematic approach to monitoring performance," enabling managers to track progress in real-time and compare it against benchmarks. For example, a KPI like "percentage of invoices paid on time" ensures financial discipline.

Decision-Making: KPIs offer data-driven insights, allowing contract managers to decide whether to escalate issues, renegotiate terms, or terminate agreements. The guide notes, "KPIs highlight variances that require corrective action."

Value for Money: The financial management aspect of L5M4 emphasizes KPIs as tools to ensure contracts deliver economic benefits. For instance, a KPI tracking "total cost of ownership" helps assess long-term savings beyond initial costs.

Risk Mitigation: By setting thresholds (e.g., maximum acceptable delay), KPIs act as early warning systems, aligning with the guide’s focus on proactive risk management.

Practical Application:

The guide provides examples like "schedule performance index" (SPI), which measures progress against timelines, and "cost performance index" (CPI), which evaluates budget efficiency. These are often expressed as ratios (e.g., SPI > 1 indicates ahead of schedule).

Another example is "service level agreements" (SLAs), where KPIs such as "uptime percentage" (e.g., 99.9% system availability) are critical in IT contracts.

In a procurement context, KPIs like "supplier lead time" (e.g., goods delivered within 7 days) ensure supply chain reliability.

Why They Matter:

The study guide underscores that KPIs bridge the gap between contract terms and actual outcomes. They transform abstract goals (e.g., "improve quality") into concrete targets (e.g., "reduce defects by 15%"). This alignment is vital for achieving strategic objectives, such as cost reduction or customer satisfaction.

KPIs also facilitate stakeholder communication by providing a common language to discuss performance. For instance, a KPI report showing "90% compliance with safety standards" reassures clients and regulators alike.

Broader Implications:

In complex contracts, KPIs may be tiered (e.g., primary KPIs for overall success and secondary KPIs for specific tasks). The guide advises balancing quantitative KPIs (e.g., cost savings) with qualitative ones (e.g., customer feedback scores) to capture a holistic view.

Regular review of KPIs is recommended to adapt to changing circumstances, such as market fluctuations or new regulations, ensuring they remain relevant throughout the contract lifecycle.

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

See the answer in Explanation below:

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

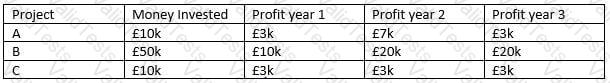

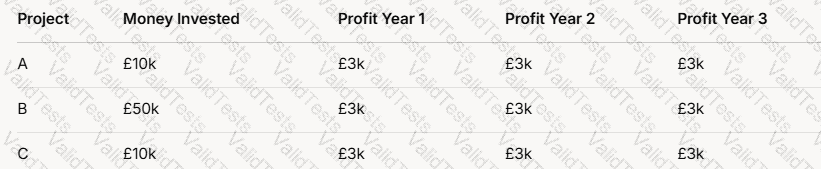

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

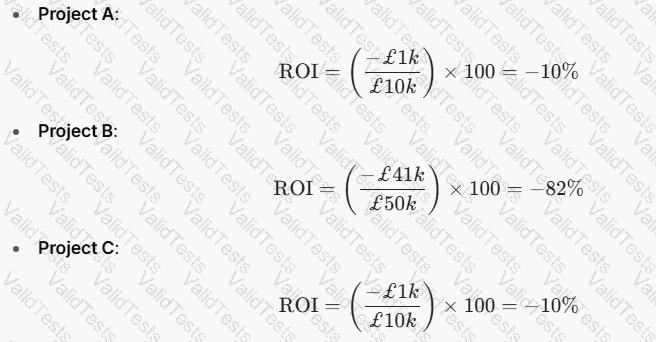

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

Outline three methods an organization could use to gain feedback from stakeholders (25 points)

See the answer in Explanation below:

Gaining feedback from stakeholders helps organizations understand their needs and improve performance. Below are three methods, detailed step-by-step:

Surveys and Questionnaires

Step 1: Design the ToolCreate structured questions (e.g., Likert scales, open-ended) tailored to stakeholder groups like customers or suppliers.

Step 2: DistributionDistribute via email, online platforms, or in-person to ensure accessibility.

Step 3: AnalysisCollect and analyze responses to identify trends or issues (e.g., supplier satisfaction with payment terms).

Outcome:Provides quantitative and qualitative insights efficiently.

Focus Groups

Step 1: Organize the SessionInvite a small, diverse group of stakeholders (e.g., employees, clients) for a facilitated discussion.

Step 2: Conduct the DiscussionUse open-ended questions to explore perceptions (e.g., “How can we improve delivery times?”).

Step 3: Record and InterpretSummarize findings to capture detailed, nuanced feedback.

Outcome:Offers in-depth understanding of stakeholder views.

One-on-One Interviews

Step 1: Select ParticipantsChoose key stakeholders (e.g., major suppliers, senior staff) for personalized engagement.

Step 2: Conduct InterviewsAsk targeted questions in a private setting to encourage candid responses.

Step 3: Synthesize FeedbackCompile insights to address specific concerns or opportunities.

Outcome:Builds trust and gathers detailed, individual perspectives.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights stakeholder feedback methods:

Surveys:"Surveys provide a scalable way to gather structured feedback from diverse stakeholders" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Focus Groups:"Focus groups enable qualitative exploration of stakeholder opinions" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Interviews:"One-on-one interviews offer detailed, personal insights, fostering stronger relationships" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).These methods enhance stakeholder engagement in procurement and financial decisions. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.