Jacinta is a Dealing Representative with WealthSource Partners Inc., a mutual fund dealer registered in Ontario. Jacinta meets with her friend Saabir, who is a licensed insurance agent. Saabir asks Jacinta for

a list of Jacinta's clients so that Saabir can reach out to them to ensure that their insurance needs are being met. Which of the following statements about Jacinta sharing the list with Saabir is CORRECT?

Quinton, a Dealing Representative, meets with his client Banji. Banji’s Know Your Client (KYC) indicates that her risk profile is “medium’’. Banji currently has $35,000 in her account which is invested 50% in the Middleton Balanced Fund and 50% in the Hector Growth Fund. She tells Quinton that she would like to contribute an additional $10,000 to purchase the Prospect Labour-Sponsored Fund. Which of the following statements about Banji’s proposed transaction is CORRECT?

Rank the decisions made by a portfolio manager in order of importance for the success of the portfolio.

Which of the following statements regarding mutual fund fees is correct?

Russell is a Dealing Representative with Wealth Quest Strategies Ltd., a mutual fund dealer and member of the Mutual Fund Dealers Association of Canada (MFDA). Russell is developing his website to

include sales content on a Target Date Fund. Which of the following is Russell permitted to include on his website about the Target Date Fund?

i. the asset mix through the life of the fund until the future date

ii. the expected decline in the fund's risk level as the fund reaches its target date

iii. the guaranteed return that the client will receive on the future date

iv. a graphic illustration of the fund's promised growth on target date

How is a $10,000 withdrawal from a registered retirement savings plan (RRSP) taxed?

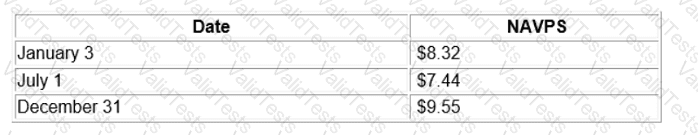

On January 3, John invests $500 in the Blue Sky U.S. Equity Fund. On July 1 of the same year, he invests another $500 into the same mutual fund. Information about the net asset value per unit (NAVPU) at the time of each transaction is provided below. Given this information, what will be the value of John's investment on December 31 of this year (please ignore transaction costs and distributions)?

Terri, 30 years old, is the marketing manager at Provincial Winery with an average annual income of $60,000. Her spouse Yvette, 28 years old, is a project manager with a telecommunications firm earning

$70,000 per year. You are helping them to organize their investments and are trying to assess their financial resources.

Which of the following is the best question to ask?

What is the step in the financial planning process that includes a discussion of a client’s household budget?

Lior is considering an investment that gains exposure to companies that trade on the Toronto Stock Exchange (TSX). He is not sure what the differences are between a Canadian equity fund and a Canadian dividend fund.

What would you tell him?