Last year Peter’s earned income from employment was $50,000.

Last year, after receiving a $2 per share in dividends from 500 shares in ABC Inc., a publicly-traded Canadian corporation, he sold his shares. The sale resulted in a capital gain of $15,000.

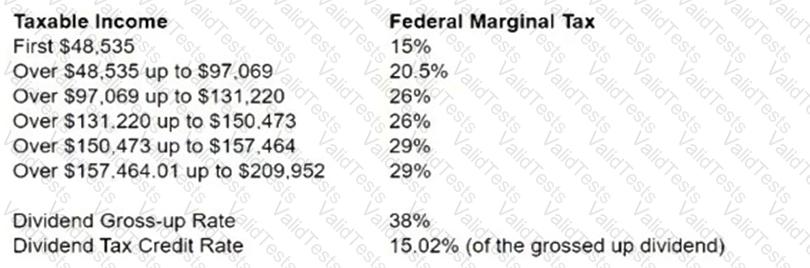

Based on the tax rates mentioned above, what is Peter’s net federal tax liability for the year? (Round to 2 decimal places).

Submit