In recent years EBITDA has been adopted by large entities as a key measure of performance. The following figures have been extracted from the financial statements of UV for the year ended 30 November 20X9:

What is EBITDA for UV for the year ended 30 November 20X9?

Give your answer to the nearest $'000.

$ ? 000

FGH plans to issue a large number of shares to the public via an IPO.

It is considering either an offer for sale at a fixed price or an offer for sale by tender.

Which of the following would be an advantage to FGH of using the offer for sale by tender compared to the fixed price offer?

Which THREE of the following statements are true in relation to financial assets designated as fair value through profit or loss under IAS 39 Financial Instruments: Recognition and Measurement?

GH acquired 3,000,000 of the 12,000,000 equity shares of JK. All shares carried equal voting rights and no other single shareholder of JK held more than 10% of the equity shares. GH has the power to participate in the financial and operating policy decisions but not control them.

Based on the information provided above, how would GH's investment in JK be accounted for in its consolidated financial statements?

Which of the following examples would be classed as related parties ofJH Ltd due to the power they possess to directly influence the company?

1: JH Ltd's managing director

2: The son of JH Ltd's managing director, who is an intern in the company's office

3: The brother of JH Ltd's managing director, whose business supplies a large amount of production material for the company

4: JH Ltd's subsidiary company, AL Ltd

5: BR PLC, one of JH Ltd's regular customers

WX acquired 20% of the equity share capital of MN for $135 million in 20X5. WX acquired a further 40% of the equity share capital of MN for $400 million on 1 October 20X8 when the fair value of the net assets of MN were $800 million.

The fair value of the initial 20% investment in MN was $175 million at 1 October 20X8. There has been no impairment of the investment in MN. WX uses the proportion of net assets method to value non-controlling interest at acquisition.

Calculate the goodwill arising on the acquisition of MN.

Give your answer to the nearest $ million.

$ ? million

On 1 January 20X7 GH purchased plant and equipment at a cost of $400,000. The temporary differences in respect of this plant and equipment at 31 December 20X7 and 20X8 have been calculated as follows:

Assume that there are no other temporary differences in the periods and that the corporate income tax rate is 25%. GH is expected to have significant taxable profits in the future.

Which of the following is the correct impact in GH's statement of financial position at 31 December 20X8 in respect of deferred tax?

The following information relates to DEF for the year ended 31 December 20X7:

• Property, plant and equipment has a carrying value of $3,500,000 and a tax written down value of $2,500,000.

• There are unused tax losses to carry forward of $1,250,000. These tax losses have arisen due to poor trading conditions which are not expected to improve in the foreseeable future.

• The corporate income tax rate is 25%.

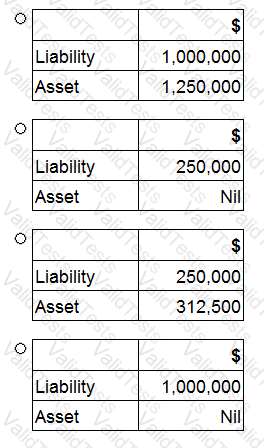

In accordance with IAS 12 Income Taxes, the financial statements of DEF for the year ended 31 December 20X7 would recognise deferred tax balances of:

AB's financial information shows that the non current assets' carrying value is greater than the tax base at the year end.

What is the journal entry to record the movement in the provision for deferred tax resulting from this difference?

RST sells computer equipment and prepares its financial statements to 31 December.

On 30 September 20X5 RST sold computer software along with a two year maintenance package to a customer. The customer is given the right to return the goods within six months and claim a full refund if they are not satisfied with the computer software. The risk of return is considered to be insignificant for RST.

How should the revenue from this transaction and the right of return be recognised in the financial statements for the year ended 31 December 20X5?