A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

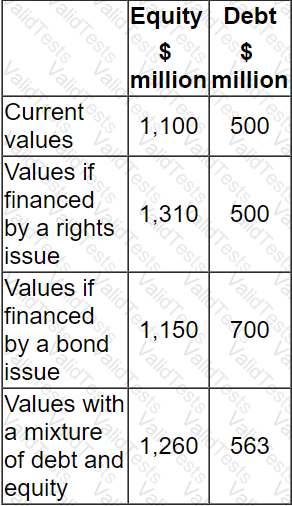

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

Submit