U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

U+ Bank uses Pega Customer Decision Hub™ to display an offer to its customers on the U+ Bank website.

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

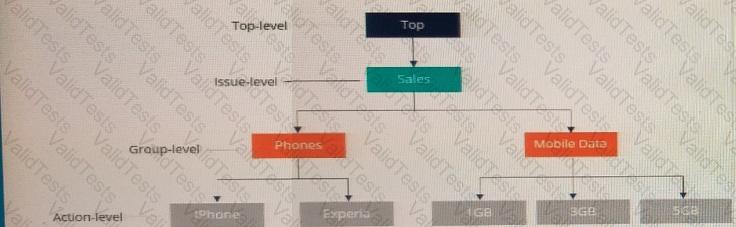

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what do you configure to select the best offer from both groups based on customer behavior?

U+ Bank, a retail bank, presents various credit card offers to its customers on its website. The bank uses artificial intelligence (AI) to prioritize the offers based on customer behavior. Since introducing the Gold credit card offer, the offer click through rate propensity has increased to 0.83.

What does the increase in the propensity value most likely indicate?

MyCo, a telecom company, wants to send promotional emails to give away phone accessories. The accessories can only be given away in batches of 50. When the stock in a batch is completed, a new batch can be promoted again.

You have decided to use volume constraint to limit the number of actions in a batch. To meet the business requirement, what Reset Interval setting do you select?

U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full customer life cycle: marketing, sales, and service.

Which two valid actions do you create? (Choose Two)

U+ Bank recently introduced a new credit card offer, Platinum Plus, for its premium customers. As the bank has some financial targets to meet, the business has decided to boost the Platinum plus card.

As a decisioning consultant, how can you ensure that the Platinum Plus offer is prioritized over other offers?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. You have already created an action flow template with the desired flow pattern and reused it for all the credit card actions.

What must you do to ensure that this action is not selected for any customers?

U+ Bank, a retail bank, wants to send promotional emails related to credit card offers to their qualified customers. The business intends to use the same action flow template with the desired flow pattern for all the credit card actions.

What do you configure to implement this requirement?

The U+ Bank marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want customers to receive more than four promotional emails per quarter, regardless of past responses to that action by the customer.

Which option allows you to implement the business requirement?