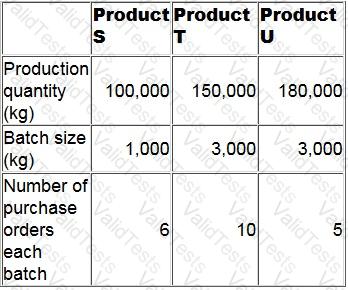

An agricultural company uses activity based costing to charge overheads to its three products. One of the main activities is purchasing, budgeted details of which are as follows:

Additional budgeted data:

What is the budgeted purchasing overhead cost per kg of Product S?

Give your answer to 2 decimal places.

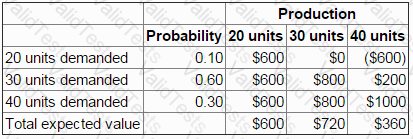

Company XPP sells a perishable product that has to be produced each day in anticipation of the following day's sales.

Any product remaining unsold at the end of the day following production is wasted.

The payoff table below shows the daily profit or loss depending on the amounts produced and sold.

A new ordering system is being discussed with customers.

The new system would require customers to order in advance to enable production each day of the following day's sales quantity, thus eliminating waste.

What is the expected increase in average daily profit if the new system is accepted by customers?

Give your answer as a whole number.

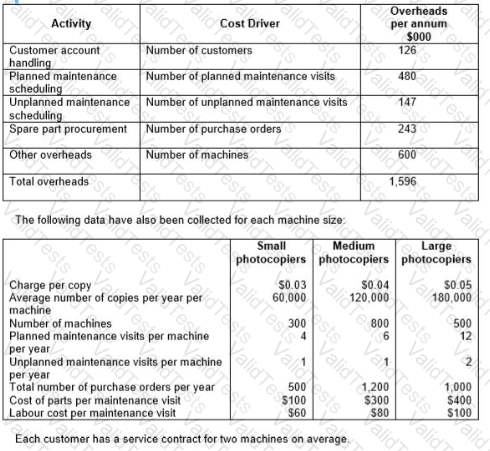

A company sells and services photocopying machines. Its sales department sells the machines and consumables, including ink and paper, and its service department provides an after sales service to its customers. The after sales service includes planned maintenance of the machine and repairs in the event of a machine breakdown. Service department customers are charged an amount per copy that differs depending on the size of the machine.

The company’s existing costing system uses a single overhead rate, based on total sales revenue from copy charges, to charge the cost of the Service Department’s support activities to each size of machine. The Service Manager has suggested that the copy charge should more accurately reflect the costs involved. The company’s accountant has decided to implement an activity-based costing system and has obtained the following information about the support activities of the service department:

Calculate the annual profit per machine for each of the three sizes of machine using activity-based costing.

Explain how probability analysis could be used to assess the risk of the evaluated projects.

Select all the true statements.

Which of the following would lead to a favourable variance?

A special contract requires 640 units of component T.

The inventory of 280 units of component T cost $0.20 per unit but the component is not currently used by the company.

The current market price of component T is $0.24 per unit but the inventory could be sold for $0.15 per unit.

The relevant cost of the units of component T required for the special contract is:

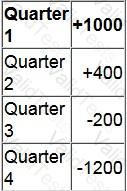

A company is forecasting sales volume using time series analysis. The following equation has been derived from past data and is considered to be a reliable predictor of future sales volume:

y = 20,000+80x

Where y is the total sales units each quarter and x is the time period (the first quarter of year 1 is time period 1).

The following set of seasonal variations for each quarter has been calculated using the additive model.

What is the forecast sales units for the second quarter of year 3?

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company’s planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company’s normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning.

The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

Select ALL the benefits for the company that could occur following the introduction of an activity based budgeting system.

Which of the following explain why standard costing is less appropriate in the contemporary business environment?

1. In a continuous improvement environment standard costing can restrict the impetus to remain as cost competitive as rivals.

2. Fixed overhead variances are less relevant as fixed costs represent a decreasing proportion of total manufacturing cost.

3. In a just-in-time environment there are fewer costs to control.

What type of budget is prepared on an annual basis taking current year operating results and adjusting them for expected growth and inflation?